Struggling with higher CPA?

Check out our SEO services to optimize your Acquisition Cost

What is a CPA Calculator?

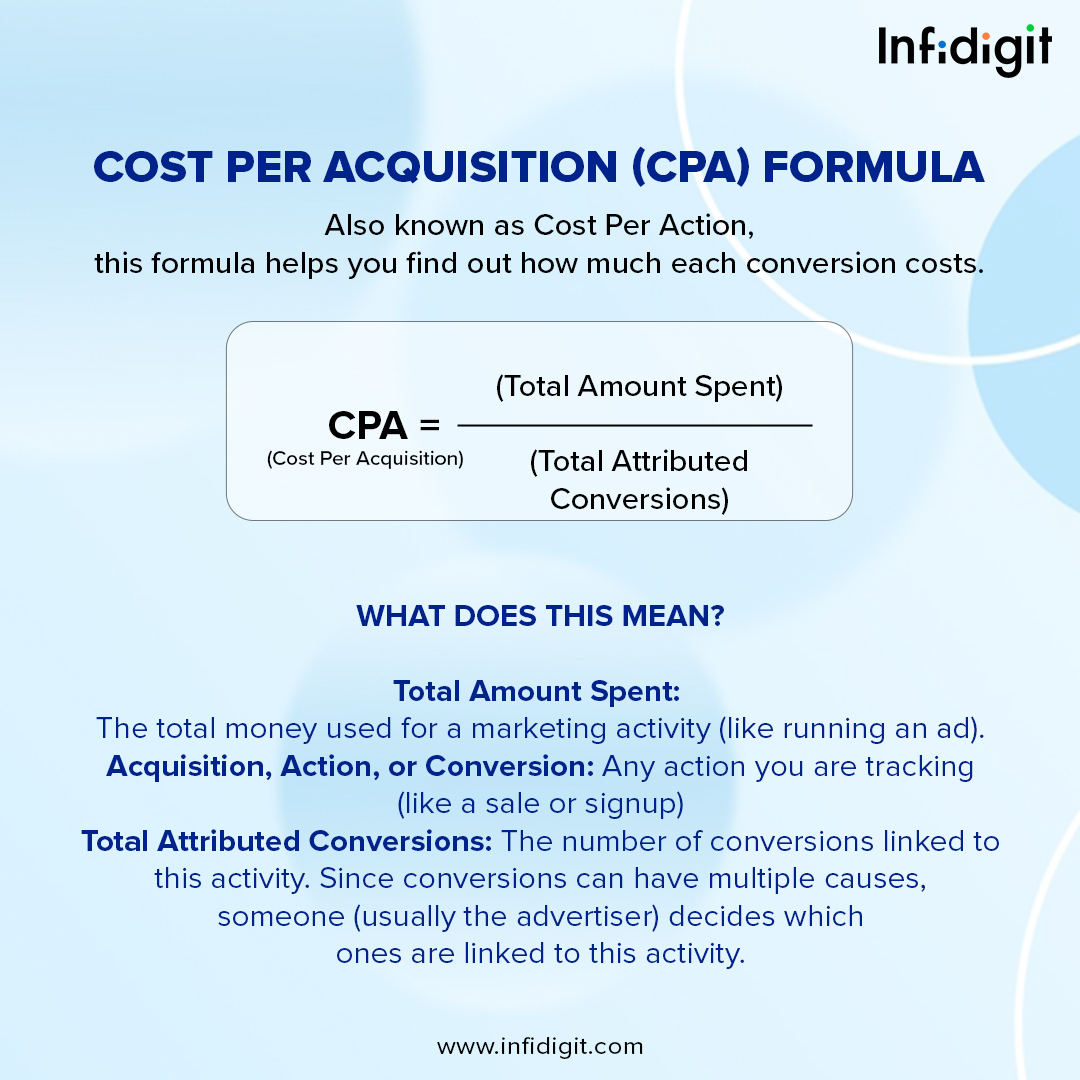

What is CPA?

Cost Per Acquisition (CPA) is a significant number that businesses watch when they’re trying to figure out how much it costs to get a new customer by running ads. It’s like a score that tells you if you’re spending your money the right way to make more sales.

CPA isn’t just about how much money is going out; it’s also about checking if your plans for getting new customers are working well. There’s something related called the acquisition rate, which is about how often people decide to buy something from you after seeing your campaign. These numbers are super important because, at the end of the day, selling stuff and making money is what businesses aim for.

By leveraging tools like a free CPA calculator and implementing strategies that enhance user experience, you can influence both the CPA and the acquisition rate, ensuring an effective utilization of your marketing budget. Understanding the nuances of CPA, such as the typical cost per acquisition rate and the factors that impact it, is critical for a successful marketing campaign.

CPA Formula with Alternate Equation for CPA Calculation

An alternative way to derive the CPA, or cost per acquisition bidding, is to modify the base equations for determining your Cost per Click (CPC) and Conversion Rate. With this approach, they first rearrange the formulas to make ‘Cost’ and ‘Actions’ the subject, leading to:

Cost = CPC × Clicks

Cost = CPC × Clicks

Actions = Conversion Rate × Clicks

By substituting these back into the CPA calculation, which is instrumental in analyzing the sale conversion rate, they end up with:

CPA = (CPC × Clicks) ÷ (Conversion Rate × Clicks)

Simplifying further, it becomes apparent that the ‘Clicks’ variable cancels out, leaving them with a clean equation:

CPA = CPC ÷ Conversion Rate

This equation, reflecting the direct relationship between CPA bidding and your conversion metric, is especially useful when they have readily available data for CPC and Conversion Rate. It’s an efficient way to understand how changes in these variables affect the CPA.

How to Use Our CPA Calculator Step-by-Step Guide?

To leverage the full potential of our intuitive CPA Calculator and attain an accurate measurement of your Cost per Acquisition (CPA), which is crucial in optimizing your email marketing campaigns, follow this comprehensive step-by-step guide:

- Begin by inserting the total dollar amount allocated to your campaign within the designated field. Whether it’s for a Google Ads initiative or an Amazon Ads placement, precise input ensures accurate CPA calculation.

- Specify the count of new customers or actions gained as a result of your advertising efforts—be it an increase in newsletter subscriptions through an email blast or conversions from targeted search engine marketing.

- With the necessary information provided, simply hit the ‘Calculate’ button. The CPA Calculator will process the data and exhibit your Cost per Acquisition, providing a clear snapshot of how your financial input translates to your campaign’s success. Remember, CPA rates can differ widely, not just across industries but also between platforms such as Google Ads and social media channels.

For detailed insights, you are encouraged to experiment by altering the total spend or acquisition numbers to simulate different scenarios. This strategy is particularly effective for subscription-based models, like a subscription box, that might monitor their digital marketing campaign’s effectiveness in attracting trial box sign-ups.

Experimenting with figures can provide a clearer picture of your current marketing effectiveness and assist in future strategic planning.

Once you have chosen your data, you’re ready to feed it into our calculator. If you’re solving for CPM, enter the total cost of your campaign and the total number of impressions it garnered.

Importance of Measuring CPA

Understanding the critical nature of measuring CPA stems from the fact that it directly affects your bottom line by reflecting the fiscal impact of your marketing efforts. Quantifying CPA offers them the following advantages:

Budget Optimization

By recognizing the CPA, they can pinpoint the most cost-effective channels, allowing for more strategic allocation of their marketing resources. It’s like perfecting an acquisition formula where every dollar spent is studied for maximum return.

Performance Benchmarking

Assessing different campaigns’ CPAs helps identify which strategies are the most efficient in terms of customer acquisition. Moreover, integrating a target ROAS (Return on Advertising Spend) ensures that not only is the cost per acquisition favorable, but it also aligns with overall revenue targets.

Strategic Decision Making

CPA metrics serve as a yardstick for informed decisions concerning the scaling of initiatives or the adjustment of existing tactics. Additionally, knowing the CPA in conjunction with ROAS metrics gives a clearer financial picture influencing the strategic thrust of marketing investments.

Long-Term Planning

By understanding the acquisition cost against customer lifetime value, they are better positioned to draft long-term marketing strategies that ensure profitability and sustainability. It’s a delicate balance of acquiring new customers while ensuring the target ROAS is met for sustained growth.

Remember, in Pay-Per-Click (PPC) advertising, a low CPA is often desirable, but it’s essential to balance it against the quality of those acquisitions and their long-term value to your business.

FAQs

1. What Is Considered a Good CPA?

A good CPA is relatively subjective and varies by industry, yet it is generally considered viable when it is less than the Customer’s Lifetime Value (CLV). CPA that amounts to less than 30% of the CLV is typically favorable, as this suggests a healthy margin. However, the most advantageous CPA is one that aligns with high profitability without compromising customer quality.

2. What are the benefits of using a CPA calculator?

Utilizing a CPA calculator streamlines the analytical process, providing swift and precise calculation of the cost per acquisition. This tool enables marketers to determine the monetary efficiency of their campaigns and make informed financial decisions for ad spending. Additionally, comparing CPAs across various campaigns and channels becomes easier, helping optimize and improve current and future marketing efforts to increase profitability.

3. How to Lower Your CPA?

Reducing your cost per acquisition requires a blend of strategic adjustments and keen analytics. Below are tips tailored to aid in achieving a lower CPA:

- Target Precisely: Concentrate your bidding strategy on marketing platforms frequented by your audience, such as Google Ads or social media, to improve relevancy and conversion rates, thus reducing CPA.

- Improve Conversion Rates: Optimize your website and landing pages for conversions. A higher convergence between Google Ads and your landing page content, for example, can lead to improved quality scores and lower CPAs.

- Increase Average Order Value (AOV): Encouraging customers to spend more per transaction dilutes the CPA across a higher revenue base. Consider integrating affiliate marketing strategies to promote higher-value products effectively.

- Encourage Repeat Sales: Implement loyalty programs and remarketing strategies that prompt customers to make multiple purchases over time. Engage with AdSense as a revenue stream and leverage its substantial user base for remarketing.

- Refine Your Offering: Ensure your product or service is compelling and fulfills customer needs. This will naturally lead to higher conversion rates and a lower CPA.

- Utilize Cross-Selling and Upselling: By recommending related or superior products, you can increase revenue without significantly raising acquisition costs and simultaneously enhance your bidding strategy.

Free SEO Tools

How useful was this post?

5 / 5. 2